White Paper Summary

Total Cost of Transportation Analysis for a Heavy-Duty Fleet

Reference: Ryder, 2025

At the recent Advanced Clean Transportation Expo, panelists highlighted that the cost of heavy-duty electric vehicles needs to reduce significantly for California’s Advanced Clean Fleets regulations to look feasible. That, and the availability of charging infrastructure and skilled technicians, the lack of which effectively increases downtime and adds to cost.

Sign up here to receive such summaries and a monthly newsletter highlighting the latest developments in transport decarbonization

5-Min Monthly

Sign-up to receive newsletter via email

Thank you!

You have successfully joined our subscriber list.

Recent Posts

Conference Summary – SAE WCX 2025

![]()

A summary of the “SAE WCX 2025” conference held in Detroit.

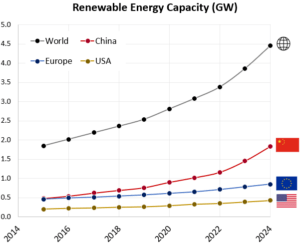

IRENA Renewable Energy Capacity Statistics 2025

![]()

According to the latest report from IRENA, 2024 saw the largest increase in renewable capacity, accounting for 92.5% of overall power additions.

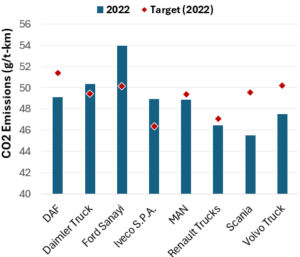

CO2 Emissions Performance of Heavy-Duty Vehicles in Europe – 2022 Results

![]()

The European Commission has published the official 2022 CO2 emission results for heavy-duty vehicles. Many OEMs are ahead of the targets and have gained credits, while others have their work cut out as we approach the 2025 target.