Policy

PM E-Drive - A Billion dollar package for electrification in India

Reference: Ministry of Heavy Industries Notification, 29th Sept, 2024

The Indian government has announced another incentive package, the PM E-Drive, to increase the uptake of electric vehicles, the associated manufacturing ecosystem, and promote charging infrastructure. This latest package aims to spend Rs. 10,900 crores, about 1.3 billion USD, over October 2024 through March 2026. Of these, nearly a billion dollars will be spent on direct incentives for electric vehicles. The rest are allocated to supporting industries and testing agencies.

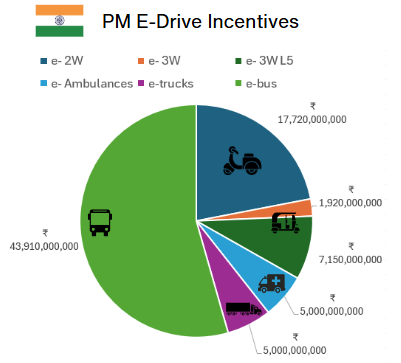

Eligible vehicles include electric two- and three-wheelers, ambulances, trucks and buses, with the distribution as shown in the adjacent figure. Notably, passenger cars are not covered in this package.

This is the fourth package announced by the government. The first, called FAME-I was funded at Rs. 895 crore ($110M), the second, FAME-II at Rs. 11,500 crore ($1.4B), the third, and the latest was the EMPS 2024 at Rs. 778 crore ($96M).

Note: The dollar figures above use a recent conversion of ~ Rs. 81 per USD.

Eligibility

As is typical of any government funding, these carry some requirements for eligibility:

- The EVs must be manufactured in India, and that the batteries must be domestically assembled, allowing that the cells and thermal management systems be imported.

- Batteries must have specific density > 70 Wh/kg and cycle life > 1000.

- There are minimum range requirements of 80 km for 2- and 3-wheelers and 120 km for buses.

- The incentives are determined on a per kWh capacity of the battery : Rs. 5000 per kWh for 2- and 3-wheelers and Rs. 10,000 per kWh for buses. There are also caps on the maximum incentives per vehicle.

- The incentives aim to incentivize a maximum of ~ 2.5 million electric 2-wheelers, ~ 335,000 3-wheelers and ~ 14,000 buses.

Remarks

We have recently posted on the changing face of mobility in India. The electrification of two- and three-wheelers can yield significant benefits for reduced emissions in urban centers.

The GHG reduction, of course, is tied to the electricity carbon intensity. India is working towards increasing renewables while also maintaining coal powered electricity to service its increasing energy needs.

According to a recent analysis done by the ICCT, electric buses are expected to reduce GHG emissions by ~ 19% compared to diesels over a vehicle lifetime from 2023 to 2035. The benefit improves as the grid gets greener. This points to the need to further decarbonize the grid rapidly to realize the full benefits of electrification. Incentives such as these are also strategic in nature, with the intent of spurring the local industry well before the full benefits are unlocked. Still, it will be very helpful for policymakers to optimize the allocation of limited public funds after a careful analysis of the cost – benefit of various available technologies, some of which are perhaps easier and cheaper to implement today (hybridization, renewable fuels, scrappage, etc.)

The allocation of incentives based on battery capacity is an intriguing idea. On one hand, it makes sense to allocate more funds to vehicles with larger needs commensurate to their battery packs. On the other hand one can envision tapering off incentives with battery capacity as a way to incentivize smaller, more efficient vehicles. Some food for thought.

Sign up here to receive such summaries and a monthly newsletter highlighting the latest developments in transport decarbonization

5-Min Monthly

Sign-up to receive newsletter via email

Thank you!

You have successfully joined our subscriber list.

Recent Posts

EPA Demands Manufacturer Data as It Expands Action on DEF System Failures

![]()

A brief summary of recent EPA changes to DEF-related failures.

EPA repeals 2009 GHG endangerment finding

![]()

The US EPA is repealing the 2009 GHG endangerment finding and terminating all vehicular GHG standards.

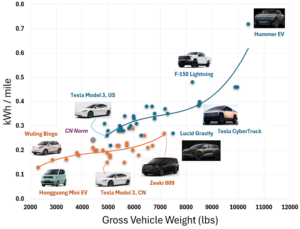

Efficiency of EVs in US and China

![]()

China has set energy efficiency norms for electric vehicles – how do modern EVs fare?