Regulations

Will Euro 7 close the gap with other major automotive markets on controlling destructive evaporative emissions?

Evaporative and refueling emissions being reviewed in Trialogue negotiations

We have covered the unfolding of Euro 7 emission standards for light- and heavy-duty vehicles in some detail now. These are yet to be finalized and seem to be stuck in back-and-forth discussions among myriad regulatory agencies.

So far, tailpipe emission standards have been dishearteningly relaxed, while new sources of pollution such as tires and batteries are getting much attention. What is missing and should also get more attention are refueling and evaporating emissions. Here’s a short write-up on that topic.

Image generated using AI (Canva / Magic Media)

As Euro 7 provisions enter final Trialogue negotiations, a key consideration is whether the European Council will support the European Commission’s and European Parliament’s commitment to enforce more stringent standards for refueling and evaporative emissions. These new limits would enable the EU to meet ambitious air quality and climate objectives cost-effectively by recovering gasoline to the consumer and aligning with technology required in all other major automotive markets. These limits would also maintain the competitiveness of European technology and supplier exports to developing international markets.

Since the last review of Euro standards, which allowed for successfully improving the real-world performance of new vehicles, there is still significant potential for Europe to reduce non-exhaust refuelling and evaporative emissions. These non-exhaust sources contain harmful pollutants including toxic compounds such as benzene and non-methane volatile organic compounds (NMVOCs) which are important contributors to the formation of fine particulate matter (PM2.5) and ozone. The introduction of stricter limits for refuelling and evaporative emissions represents a necessary step forward in improving the air quality for European citizens as already documented in the peer-reviewed literature.1,2

As far as the technologies to control these emissions are concerned, the standards proposed by the European Commission are based on commercially available and affordable technologies, including on-board refuelling vapour recovery (ORVR) and associated activated carbon canister technology, with an estimated cost of €16/vehicle.3 Such control technologies needed to meet the proposed refuelling and evaporative emissions limits of Euro 7 have already been developed by automotive suppliers and have demonstrated ultra-low emissions in-use for the full useful life of the vehicle.4,5,6

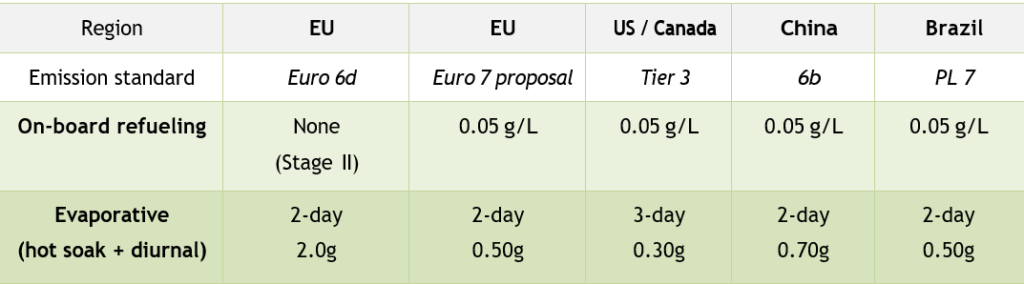

Furthermore, automotive manufacturers have already cost-effectively implemented these control technologies in their vehicle fleets in other global markets, such as the US, China and Brazil, whose emissions standards currently exceed those in force in the EU as detailed below.

Due to the efficiency and affordability of the technologies available, automotive manufacturers can now scale up their fleets for the European market at affordable costs and allow automotive manufacturers and suppliers to broaden their market reach. This will result in stimulating both domestic demand and supply while increasing air quality for EU citizens. As such, the new technologies’ costs related to Euro 7 would be incremental compared to the concrete environmental and air quality benefits it would deliver.

Since refuelling and evaporative emissions control technology solutions are available, demonstrated to maintain their high control efficiency, and successfully implemented across the world outside the EU, the refuelling and evaporative emissions standards proposed by the European Commission and supported by the European Parliament represent a balanced option for substantially improving air quality and returning lost fuel to the vehicle owner.

Despite recent efforts by Member States and cities to further control pollutant emissions, air quality remains a major concern in Europe, with direct effects on the environment and public health. Tightening the limits for refueling and evaporative emissions is therefore a concrete way of improving citizens’ quality of life, harmonizing the global market and broadening the supplier market. The decision of whether Euro 7 will close the gap with other major automotive markets on controlling these destructive evaporative emissions lies with the Trialogue negotiators, especially those in the European Council.

References

1 Effectiveness of emissions standards on automotive evaporative emissions in Europe under normal and extreme temperature conditions, 19 August 2022 (here)

2 The role of NOx emission reductions in Euro 7/VII vehicle emission standards to reduce adverse health impacts in the EU27 through 2050, September 2022 (here)

3 Euro 7 impact assessment study, European Commission, November 2022 (here)

4 Summary and Analysis of 2000-2015 Model Year IUVP Evaporative and Refueling Emission Data, SAE, September 2017 (here)

5Refueling Vapor Recovery: A history of U.S. experience with ORVR and Stage II; a discussion on refueling emissione generations and emissions from gasoline dispensing facilities, and a synopsis of ORVR and Stage II implementation, in-use efficiency, and cost-effectiveness, February 2020 (here)

6A statutory and regulatory history of the U.S. evaporative requirements for motor vehicles and analysis of European evaporative emissions requirements, February 2020 (here)

Sign up here to receive such summaries and a monthly newsletter highlighting the latest developments in transport decarbonization

5-Min Monthly

Sign-up to receive newsletter via email

Thank you!

You have successfully joined our subscriber list.

Recent Posts

EPA Demands Manufacturer Data as It Expands Action on DEF System Failures

![]()

A brief summary of recent EPA changes to DEF-related failures.

EPA repeals 2009 GHG endangerment finding

![]()

The US EPA is repealing the 2009 GHG endangerment finding and terminating all vehicular GHG standards.

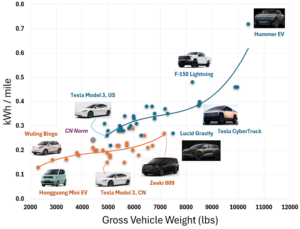

Efficiency of EVs in US and China

![]()

China has set energy efficiency norms for electric vehicles – how do modern EVs fare?