Journal Paper Summary

EV Cost of Ownership Parity a Decade Away?

New study analyzes the cost of transition to electric vehicles in California, including socio-economic factors. The burden will shift to lower income groups in later years.

Reference

Debapriya Chakraborty, Adam W. Davis, Gil Tal,

“The cost of aggressive electrification targets – Who bears the burden without mitigating policies?” Transportation Research Interdisciplinary Perspectives, Volume 23, 2024, 101006

https://doi.org/10.1016/j.trip.2023.101006

A recently published study examines the interplay between vehicle costs and socioeconomic factors and their impact on the transition to electrification of light-duty vehicles. Specifically, it examines the cost of the transition, and how it will be borne by various income groups, if electric vehicle (EV) mandates are imposed without mitigating policy steps.

The study estimates the cost of transitioning to 100% EV sales by 2035 in California, through a combination of total cost of ownership (TCO) analysis with an EV diffusion model, and the assumption that requirements of California’s Advanced Clean Cars II EV targets are met: EVs allocated 26% of sales in 2026, increasing to 100% in 2035.

The main finding is that the TCO of new EVs will remain higher than of ICE vehicles for another decade for most of the population in California. And it points to the need for financial incentives and charging infrastructure adjusted to socioeconomic needs, without which, the authors conclude that consumers will not choose to transition to EVs by the targeted dates.

Sign up here to receive such summaries and a monthly newsletter highlighting the latest developments in transport decarbonization

5-Min Monthly

Sign-up to receive newsletter via email

Thank you!

You have successfully joined our subscriber list.

Recent Posts

Conference Summary – SAE WCX 2025

![]()

A summary of the “SAE WCX 2025” conference held in Detroit.

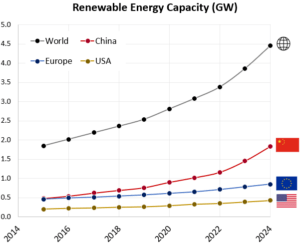

IRENA Renewable Energy Capacity Statistics 2025

![]()

According to the latest report from IRENA, 2024 saw the largest increase in renewable capacity, accounting for 92.5% of overall power additions.

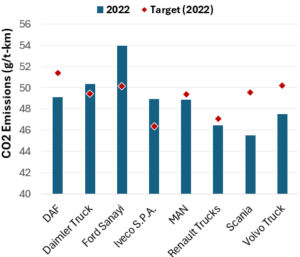

CO2 Emissions Performance of Heavy-Duty Vehicles in Europe – 2022 Results

![]()

The European Commission has published the official 2022 CO2 emission results for heavy-duty vehicles. Many OEMs are ahead of the targets and have gained credits, while others have their work cut out as we approach the 2025 target.