Conference Summary

Notes from the 2023 Sustainable Fleet Technology Conference

Raleigh, NC, August 15- 16, 2023

The 2023 Sustainable Fleet Technology Conference held at Raleigh, N. Carolina covered a wide range of practical issues for fleet decarbonization. The content was geared mostly towards heavy-duty vehicles, although some discussions pertained to light-duty as well. Here are some notes.

(To respect the rules of such conferences, we avoid attributing notes to specific speakers)

Conference website: https://www.sustainablefleetexpo.com/

From top left –

Propane powered generator for recharging BEVs; Electric auxiliary power units and power take-off units (6 – 28 kWh batteries); All electric bucket truck; Don’t try getting away from Durham cops – they drive Mustang Mach Es now; Electrifying pickup truck fleet;

And sustainable fuel outside the conference (who knew soy burgers could taste that good !)

Charging of heavy-duty fleets

- Charging infrastructure is the main barrier today. Trucks are ready well ahead of charging stations

- “Talk to utilities early and often”

- “Fleet clustering” – where multiple vehicles electrify together, can result in a severe (> 25MW) demand on the utilities

- But utilities cannot add grid capacity without an explicit new demand à leads to chicken-and-egg problem of EV trucks waiting on infrastructure and vice versa

- From planning to installation, it can take up to 2 years to get charging infrastructure in place

- Smart charging and rate adjustments

- Current charging procedures are not smart – vehicles are charged at end of shift irrespective of time of day.

- Demand management systems are being developed and deployed à unlike in other industries, this is not energy reduction but cost management by shifting the time of charging

- Modular charging units developed – can be used for charging several vehicles at various power levels with optimal power sharing. Software helps optimize charging according to electricity price.

- Not all want high speed charging – some customers are opting for lower speed charging to avoid peak hour charging costs

- Utilities are expected to update electricity rates to encourage charging in off-peak hours.

- Vehicle-to-grid charging is not mature and attractive – utilities are not exactly setup to receive electricity back from vehicles and fleets should not expect to make up significant charging costs through selling electricity back to the grid (plus V2G hardware is expensive)

- DC fast charging is currently not profitable for most companies today

Electric vehicles

- School buses are ideal for electrification given the short driving distances, but a lot of consulting time is required to persuade customers to but electric buses, unlike diesels

- Some EV pickup trucks can be “too powerful” for government fleet applications ! (See picture above for the Mustang Mach-E for Durham cops .. the speed is likely welcome there)

- For businesses, there is little room for EV failure where profit margins are tight and down time = loss in profit

- Stellantis BEV portfolio will include > 25 vehicles by 2030. Plan is to roll out EV RAM commercial vans and pickup trucks, Jeep SUVs and family cars in the next year or two.

Light-Duty : Supply chain, Dealership and Consumer perspectives

- The industry is past the supply chain issues and now the bottleneck is that of logistics – transporting cars from manufacturing to dealerships

- Dealers are very supportive of selling EVs, but EVs are backing up on dealership lots: there are over 3 months of EV inventory on dealership lots.

Days’ supply of inventory on dealership lots | June 2022 | June 2023 |

ICE | 38 | 53 |

EV | 43 | 103 |

Consumer preference for EVs:

- Over 90% of customers buy vehicles based on monthly payments – not on total cost of ownership (TCO) or sticker price

- Second most important consideration is the resale value of the vehicle – and that is not clear yet for EVs

Low carbon fuels

- For H2 powered vehicles, the cost of fuel is the key barrier. H2 costs are very high even in California (as high as $16 / kg was cited – note that DOE wants to target $1/kg !)

- Renewable liquid propane target : 700M gallons by 2030 and 2B gallons by 2035.

- Some propane-fueled vehicles are certified today at 0.007 g/bhp-hr NOx (EPA low NOx limit for 2027 is 0.035 g/bhp-hr)

- 100% biodiesel (B100) can reduce GHG emissions by > 70%. Goal is to produce 6B gallons by 2030 (can be done confidently) – resulting in 50 MMT of CO2 avoided – and 15B gallons by 2050

Sign up here to receive such summaries and a monthly newsletter highlighting the latest developments in transport decarbonization

5-Min Monthly

Sign-up to receive newsletter via email

Thank you!

You have successfully joined our subscriber list.

Recent Posts

EPA Demands Manufacturer Data as It Expands Action on DEF System Failures

![]()

A brief summary of recent EPA changes to DEF-related failures.

EPA repeals 2009 GHG endangerment finding

![]()

The US EPA is repealing the 2009 GHG endangerment finding and terminating all vehicular GHG standards.

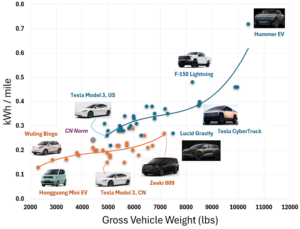

Efficiency of EVs in US and China

![]()

China has set energy efficiency norms for electric vehicles – how do modern EVs fare?