Policy Update

Summary of section 45V of the IRA for clean hydrogen

Final rules for Clean Hydrogen Production Tax Credit published by the U.S. Department of the Treasury and Internal Revenue Service

Background

Section 45V of the US Inflation Reduction Act (IRA) provides an income tax credit for the production of qualified clean hydrogen. After considering over 30,000 comments and discussions across agencies and experts, the Department of Treasury has finalized the rules, providing clarity on eligibility requirements of various hydrogen production pathways, and the methodology for tax credit evaluation.

Full Report Available to MobilityNotes Members

In 2025, MobilityNotes will have a paid members-only section, with expanded downloadable content, webinars, white papers, international coverage, and more.

For now, subscribe to the free monthly newsletter below.

Sign up here to receive such summaries and a monthly newsletter highlighting the latest developments in transport decarbonization

5-Min Monthly

Sign-up to receive newsletter via email

Thank you!

You have successfully joined our subscriber list.

Recent Posts

EPA Demands Manufacturer Data as It Expands Action on DEF System Failures

![]()

A brief summary of recent EPA changes to DEF-related failures.

EPA repeals 2009 GHG endangerment finding

![]()

The US EPA is repealing the 2009 GHG endangerment finding and terminating all vehicular GHG standards.

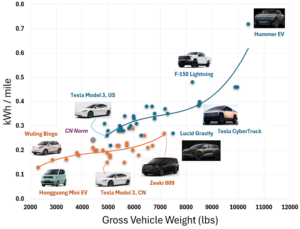

Efficiency of EVs in US and China

![]()

China has set energy efficiency norms for electric vehicles – how do modern EVs fare?