Spotlight

Mobility in India

Excerpts of recent articles from the Times of India and Financial Express

Note: This is a thin slice of information collected over two weeks of “vacation” and is not intended to provide a comprehensive status of transportation in India. As such, read it to get the broad-stroke changes happening in the region.

Electric Vehicles

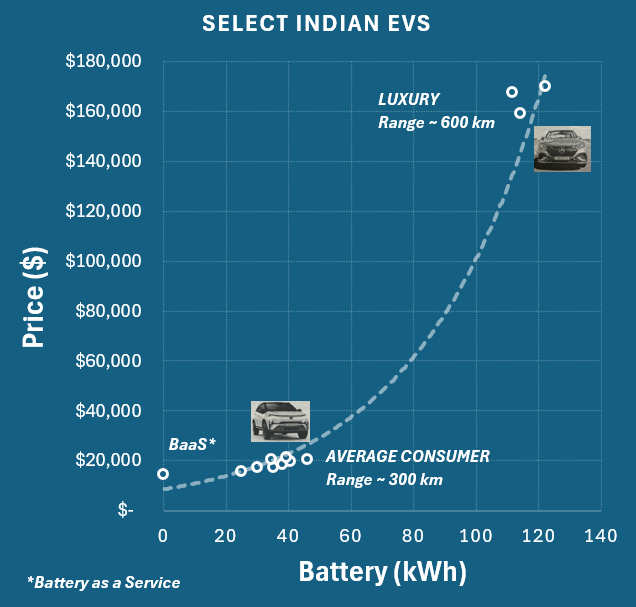

There seem to be three segments of EVs being promoted –

- Those aimed at mass adoption / entry point EVs, with driving range of ~ 300 km and small 25 – 45 kWh batteries, priced in the $15 – 20K range.

- Luxury EVs (BMW, Mercedez-Benz, etc.) – which are western imports.

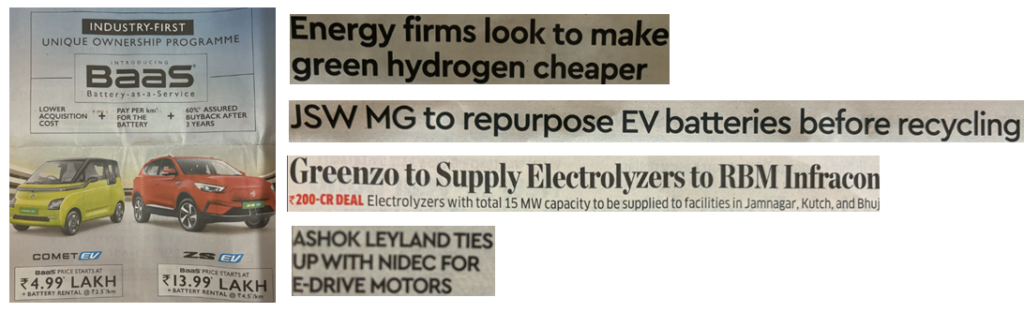

- Battery as a service – where the vehicle price is ~ 25% lower and the consumer can pay for battery pack on a per km basis. For one advertised model, the total cost of car and BaaS was same as that of the entire vehicle after running the vehicle for 10 years with 10,000 km each year.

The chart is based on information provided in the articles. Actual prices will be likely higher when accounting for tax, registration, and insurance.

OEMs in the news

Toyota alliance with Suzuki in India is delivering gains – profits have tripled. Toyota Kirloskar Motors (TKM) is now the 5th largest carmaker in India.

Leapmotor, in partnership with Stellantis, was aiming to introduce EVs in India starting Q4 2024, but those plans seem to have been shelved for now. India has recently blocked BYD’s plans of investment in manufacturing in India.

Kia will launch a mass-market EV in 2025, and also consider hybrids based on market demand. Current Kia EV imports – the EV6 and EV9 cost ~ $80K and ~ $155K, clearly not for the average consumer – while the new EV could be priced at ~ $25K according to analysts (still quite expensive for the Indian market).

Nissan has announced the launch of an electric SUV for the Indian market in 2026, with an aim to price it “very close to a similar-sized ICE car”. The EV is being co-developed with Renault India. The OEM is also considering other powertrains including hybrids and CNG.

The President of BMW India has called for a “green tax” on cars based on the emissions level (rather than the size of the vehicle). BMW is not considering introducing any PHEVs in the absence of any incentives.

Mahindra & Mahindra launched a mini electric cargo vehicle, the Zeo, with a range of 160 km, and priced at ~ $9,000 excluding taxes, registration, and insurance

Batteries, Motors, Electrolyzers

Ashok Leyland has partnered with Japanese firm Nidec for developing e-drive motors for commercial vehicles.

JSW MG Motor India, a joint alliance of JSW and SAIC, has tied up with Vision Mechatronics, to repurpose spent EV batteries for second life use in power backup systems.

Battery as a service being offered, where EV buyers can pay per km of driving.

This particular ad shows the price of the mini EV at ~ $6K and the other one at ~ $16K (most likely before any taxes, registration & insurance), while the battery rental at Rs. 2.5 – Rs. 4.5 per km, which roughly translates to Rs. 37,000 – Rs. 67,000 ($450 – $800) per year considering a 15,000 km annual driving distance.

Greenzo Energy signed a MoU with RBM Infracon to invest ~ $25M to supply electrolyzers with capacity of 15MW. The green H2 produced will be supplied to steed manufacturers, refineries and petrochemical producers.

Green H2

India has set a target of 5 MT of green H2 production by 2030. Several companies are working on reducing the cost of H2 production. Various companies are participating –

- Avaada aims to increase efficiency through integration of AI and advanced analytics with the energy management system to lower stack energy consumption.

- Thermax has partnered with Ceres to make stack array modules based on oxide electrolysis and improve the system efficiency by 25% vs competition.

- Reliance Industries is looking to invest $10 billion in green H2 ecosystem and has set a goal of $1 per kg production cost. An electrolyzer gigafactory is expected to be operational in 2026.

- Adani Group plans to develop green H2 production of up to 1MMT per year by 2030.

- Hygenco plans to produce 1.1 million tons of green ammonia per year by end of 2030.

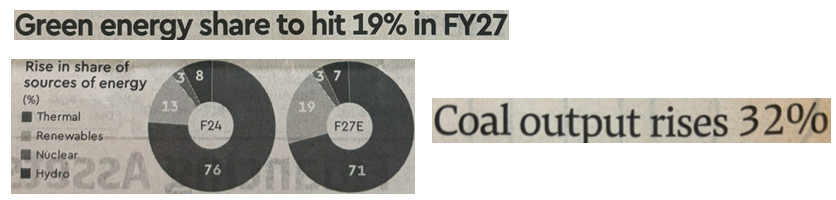

Energy

Morgan Stanley projects that the share of renewable energy will increase from ~ 14% today to ~ 19% in 2027. India’s power demand is expected to increase at a annual CAGR of 7% in that period. Supporting this increased demand will require an increased contribution from all sources including thermal (coal), hydro, but renewables are expected to increase the most.

In the meantime, coal output increased by a whopping 32% in April – September compared to the same period last year.

Policy

- India and US have signed a Memorandum of Understanding (MoU) to “expand and diversity critical minerals supply chains”, for use in semiconductors, electric vehicles, solar modules, etc.

- India imports 57% if its edible oil consumption. A “National Mission on Edible Oil” is funded to increase the production of oilseeds such as soybean, groundnut, etc. from 39MT to 69.7 MT by the end of the decade. Note that from a transportation perspective, this suggests that use of edible oils (and associated land) for food takes precedence over renewable fuels.

- The Indian Government will likely announce mandates for blending of sustainable aviation fuels (SAFs) in domestic flights, only after mandates for international flights take effect, expected in 2027. A committee on SAF had recommended an initian blending mandate of 1% starting 2025 and scaling it to 2% by 2028. The high cost of SAFs is seen as a deterrent by the airline industry with fuel costs accounting for 40% of Indian airlines’ operational expenses.

Sign up here to receive such summaries and a monthly newsletter highlighting the latest developments in transport decarbonization

5-Min Monthly

Sign-up to receive newsletter via email

Thank you!

You have successfully joined our subscriber list.

Recent Posts

EPA Demands Manufacturer Data as It Expands Action on DEF System Failures

![]()

A brief summary of recent EPA changes to DEF-related failures.

EPA repeals 2009 GHG endangerment finding

![]()

The US EPA is repealing the 2009 GHG endangerment finding and terminating all vehicular GHG standards.

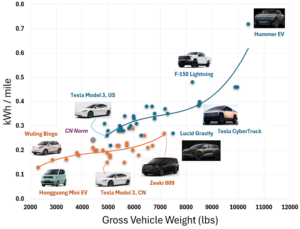

Efficiency of EVs in US and China

![]()

China has set energy efficiency norms for electric vehicles – how do modern EVs fare?