Is the industry ready to meet the battery demand ?

Key Takeaway 1

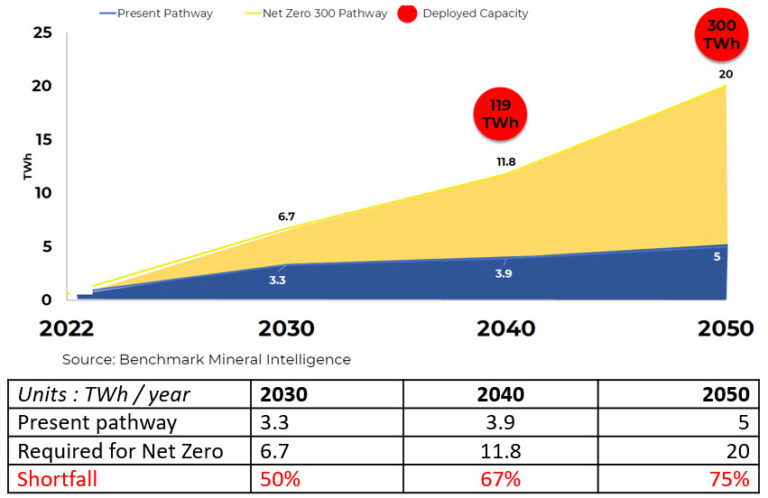

There is a big – and widening – gap between anticipated supply of batteries and required capacity for supporting net zero goals via electrification

- Global capacity of battery cells has increased significantly in recent years

~ 450 GWh in 2021 and ~ 700 GWh in 2022. There are 160 active gigafactories by EO2022.

- But global battery supply expected to significantly lag demand

Demand growth due to diverse end needs such as road transport, storage, consumer electronics, heating, marine, etc. but also due to increase in battery pack, recalls, spare batteries for swapping stations,

- Increase in Li-ion battery capacity is estimated to slow after 2030 due to battery material constraints

Key Takeaway 2

Battery capacity ≠ supply

This may sound obvious but announced battery capacity does NOT translate to actual production. The difference can be big.

Benchmark estimates capacity of ~ 5TWh and supply of ~ 3.3 TWh by the end of this decade.

Key Takeaway 3

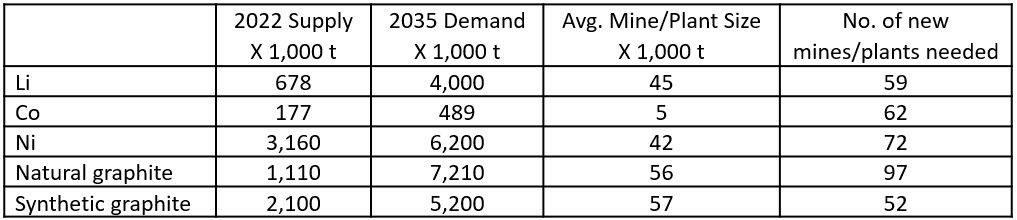

Battery supply is constrained by raw materials. A lot more mines are needed.

If moving to Ni-rich batteries, Ni demand expected to increase to 6.2M tons in 2030 and forecast to exceed supply after 2027.

Key Takeaway 4

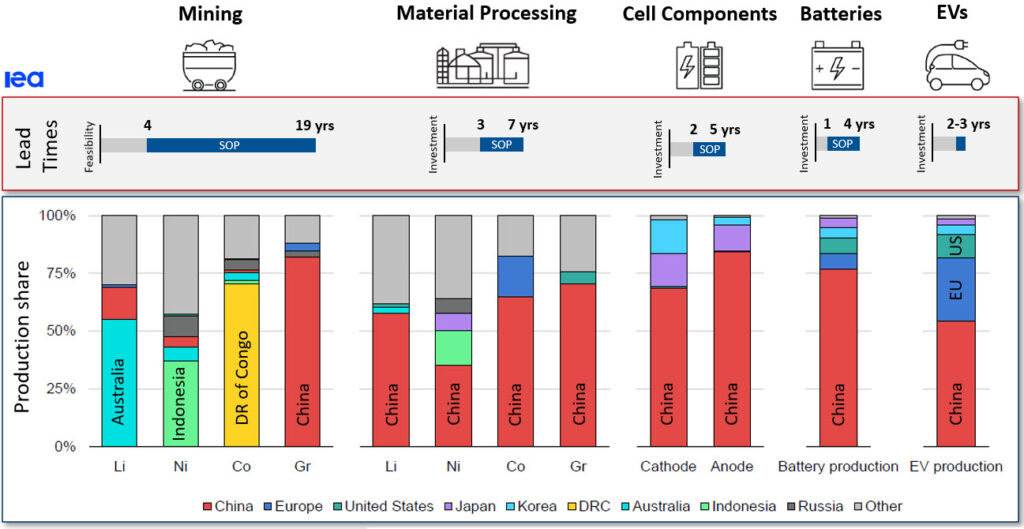

Setting up a mine from exploration to production can take 5 – 25 years

- Other than the work required for the actual mining, other key bottlenecks today are acquiring government permits and overcoming any environmental / local concerns. US permitting process takes 7 – 10 years.

- Other time constants : Raw material processing 1 – 3 years, cathode/anode production 2 – 3 years, cell manufacturing 2 – 5 years.

- Average delay for Li projects is 2.4 years (planned vs actual SoP)

Key Takeaway 5

Recycling will have to plan an important role in the future

To support net zero, LCE (lithium carbonate equivalent) production will have to increase ~ 20 times by 2050. Given raw material constraints, recycling will have to play a key role – 40% of battery raw materials will have to come from recycling.

Key Takeaway 6

China dominates the entire battery supply chain

In 2022, China is forecast to produce 70% of battery cells, 78% of cathode, 91% of anodes.

It also dominates in processing of the minerals. The picture tells the story.

Capacity of cathodes (existing + planned)

Global > 18M tpa

China > 16 M tpa (87%)

New added capacity in 2022 Jan – Oct

> 85% is from China, 80% is LFP

Summary of an earlier IEA article

Source: IEA “Global Supply Chains of EV Batteries”. Analyses based on Heijlen et al. (2021); Benchmark Mineral Intelligence; S&P Global; US Geological Survey (2022); Bloomberg NEF

Key Takeaway 7

On battery raw materials prices – expected to remain elevated but not the major contributor to EV price increase

- Based on conversations with a few experts in the audience, the consensus seems that the battery metal price increase is not expected to go away anytime soon given the tremendous growth estimated for battery demand (and the supply shortfall covered earlier).

- Based on NCM 811 cell chemistry, here is the cost breakdown for an EV:

Battery accounts for 30% of car cost à Cell accounts for 80% of battery cost à Cathode accounts for 40% of cell cost à Metals account for 60% of cathode cost

- EV prices have increased due to several factors – such as unavailability of chips – and only marginally due to battery raw material price increase

- Cathode market is expected to grow from ~ 300 ktons/year in 2022 to ~ 1,800 and 2,800 ktons/year by 2030 and 2035, respectively. About half of the materials expected to go into LFP, a quarter in NCA/NMC and another quarter in LNMO, LMR

Key Takeaway 8

Battery manufacturers are diversifying chemistries

- LFP is the dominant battery chemistry produced in China. Of the 221 GWh of batteries produce in China in 2022 Q1 – Q3, ~ 60% were NMC811 is at #2, NMC532 at #3 and NMC622 at #4.

- Globally, NMC, 622 is the highest selling battery chemistry. Trend is for higher Ni, Co-free.

- Watch for new chemistries: sodium ion, LMFP, Solid-state. And relying on recycled materials.

- Big switches are not happening. It is not clear which chemistry works best for each end use case.

- GM is exploring Li-protected anode with liquid electrolyte (500 deep charge-discharge cycling tests done) and Si-anodes. Currently using NCMA in Ultium batteries to reduce cobalt, battery pack weight and increase capacity (60% higher vs Bolt EV)

- BASF is looking into 3 cathode chemistries: high-energy density NCA & NCM, ultra-high Ni cathode (Ni > 90%, Co < 5%) and Co-free cathodes.

Key Takeaway 9

OEMs are going deeper in the supply chain to assure battery availability

While OEMs are setting up joint ventures for battery manufacturing, there are increasingly direct purchase agreements with battery component and even raw material mining suppliers.

GM has binding agreements to secure battery raw materials supporting 1M units of annual capacity in NA by end of 2025.

Key Takeaway 10

IRA is having a positive impact, but long way to go before US catches up with China

The IRA will require 75% of battery material supply to come from free-trade agreement regions à totally impractical considering the maturity of existing supply chain contracts.

Announcements on cathode production so far (due to IRA) are a small fraction of the total capacity.

Sign up here to receive such summaries and a monthly newsletter highlighting the latest developments in transport decarbonization

5-Min Monthly

Sign-up to receive newsletter via email

Thank you!

You have successfully joined our subscriber list.

Other recent posts

Conference Summary – SAE WCX 2025

![]()

A summary of the “SAE WCX 2025” conference held in Detroit.

IRENA Renewable Energy Capacity Statistics 2025

![]()

According to the latest report from IRENA, 2024 saw the largest increase in renewable capacity, accounting for 92.5% of overall power additions.

CO2 Emissions Performance of Heavy-Duty Vehicles in Europe – 2022 Results

![]()

The European Commission has published the official 2022 CO2 emission results for heavy-duty vehicles. Many OEMs are ahead of the targets and have gained credits, while others have their work cut out as we approach the 2025 target.