Inflation Reduction Act A summary for electric vehicles

In case you are confused by the Inflation Reduction Act in the US and it’s implications for electric vehicle incentives, then you are not alone. It’s an evolving story, and the U.S. Treasury Department is making clarifications to help consumers understand what’s in it for them. The latest revised guidelines expand the list of vehicles which qualify for the $7,500 tax credits. Here’s a summary, with more to come later this year.

Inflation Reduction Act (IRA) basics

IRA credits and eligibility

The IRA provides tax credits – referred to as “30D Clean Vehicle Credits” for the purchase of “Clean vehicles” defined as those with gross vehicle weight rating (GVWR) < 14,000 lbs, with final assembly done in North America and propelled by electric motor using a rechargeable battery ≥ 7 kWh (that is, all plug-in and full electric vehicles).

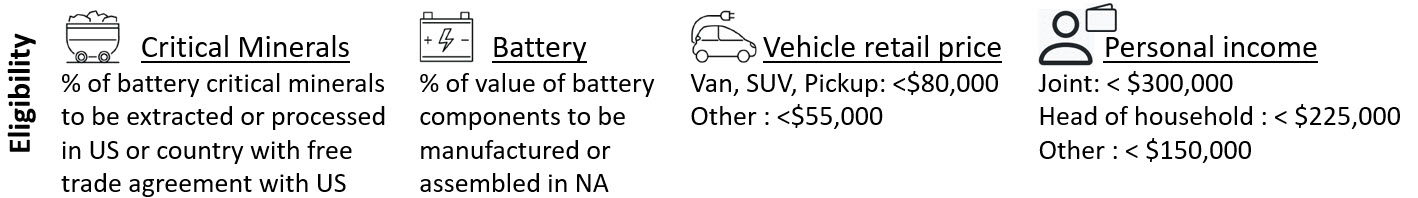

The tax credits are “up to” $7,500 – broken into $3,750 if certain requirements on Critical Minerals are met and another $3,750 if requirements on battery sourcing are met. There are further requirements on vehicle price and personal income that need to be met to be eligible for the credits.

The picture here provides a summary of the various eligibility requirements:

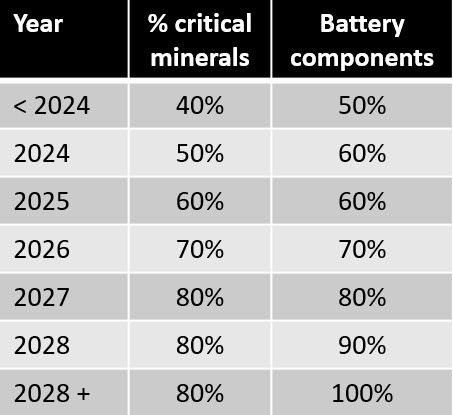

Starting 2024, for a vehicle to be eligible for tax credits, over half of the critical minerals used in its batteries must be extracted or processed in the U.S. or coutries with which it has free trade agreements (sorry N. Korea). And over 60% of the value of battery components must be associated with manufcaturing or assembly in N. America. The requirements increase with time as shown in this table. After 2028 all battery components must be made in N. America to avail of $3,750 tax credits. The idea here is to encourage local manufacturing and help the US close the gap with China on electric vehicles.

Update to vehicle classification

Note in the figure above, that vans, SUVs, and pickup trucks must be priced below $80,000 to be eligible for credits, while sedans must be below $55,000. On February 3rd, 2023, the IRA issued an update to the vehicle classifications that determines the eligibility for tax credits.

The update includes :

The use of standard displayed on the vehicle label and on FuelEconomy.gov rather than the EPA CAFE standard

Consistent treatment of crossover vehicles that share similar features

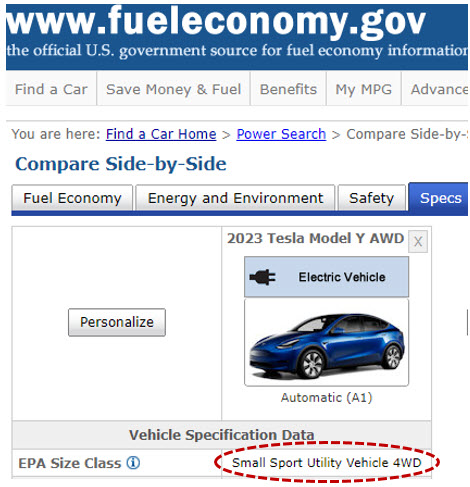

Basically what this means is that some vehicles – such as the Tesla Model Y – which were previously not classified as SUVs, now do get classified as such, and are therefore eligible for the tax credits.

See picture here which shows that on the EPA Fuel Economy website, the Tesla Model Y is classified as an SUV.

What Next?

The Treasury Department is not done. There are more clarifications expected on the critical mineral and battery requirements, which will be issued in March. So more to come on this.

Further Reading

Here’s an article which summarizes the current list of vehicles eligible for the IRA credits.

Link to the U.S. Treasury Department update.

5-Min Monthly

Sign-up to receive newsletter via email

Thank you!

You have successfully joined our subscriber list.