CO2 compliance pathways for EPA MY 2027+ proposal - A case-study

How are light-duty cars and trucks expected to meet future EPA fuel economy standards? What level of electrification would be required? Would hybrids play a role? How does one go about calculating it? Here’s a case study attempting to address some of these questions.

The U.S. EPA has recently published a proposal to significantly reduce tailpipe emissions from MY 2027+ light-duty vehicles. See here for a downloadable summary.

We now look at how an auto manufacturer could go about meeting the CO2 requirements, focusing on model year 2030 targets.

Disclaimer

This is a purely mathematical exercise, not intended to actually predict or influence the course of action at any OEM. Please take the information as purely educational, and get back if you see errors.

Assumptions / Inputs

- This is a “mock” fleet study and is done only to show the calculation methodology and possible technology choices. We have chosen Ford and only some of their vehicles as a starting point to build the fleet, simply because the F-150 is the most popular light-duty vehicles in the US, and because of the nice diversity of hybrid and electric models available in the Ford fleet today.

- We have only chosen one version for each of their models (e.g. if a model has a 2.4L, 2.7L, 3.3L engine, we chose one variant ..)

- The starting point is the MY 2021 data – sales numbers are taken from public sources and EPA 2-cycle fuel economy numbers are taken from the EPA database.

- The overall sales and the total sales for each model (combined ICE + hybrid + electric variants) is kept constant going from MY 2021 to MY 2030. This is clearly a great simplification, but again the focus is on understanding how a fleet today would meet the future requirements.

- We have introduced new hypothetical full electric, hybrid and plug-in hybrid variants (such as of the Bronco) to enable meeting the 2030 requirements. The CO2 emissions for such new hybrids and plug-in hybrids are considered to be 20% and 50% lower, respectively, vs. the reference ICEs. These are well-supported assumptions based on the fuel economy figures from current hybrids and from the recent utility factor curves by the EPA (see proposal summary at link above).

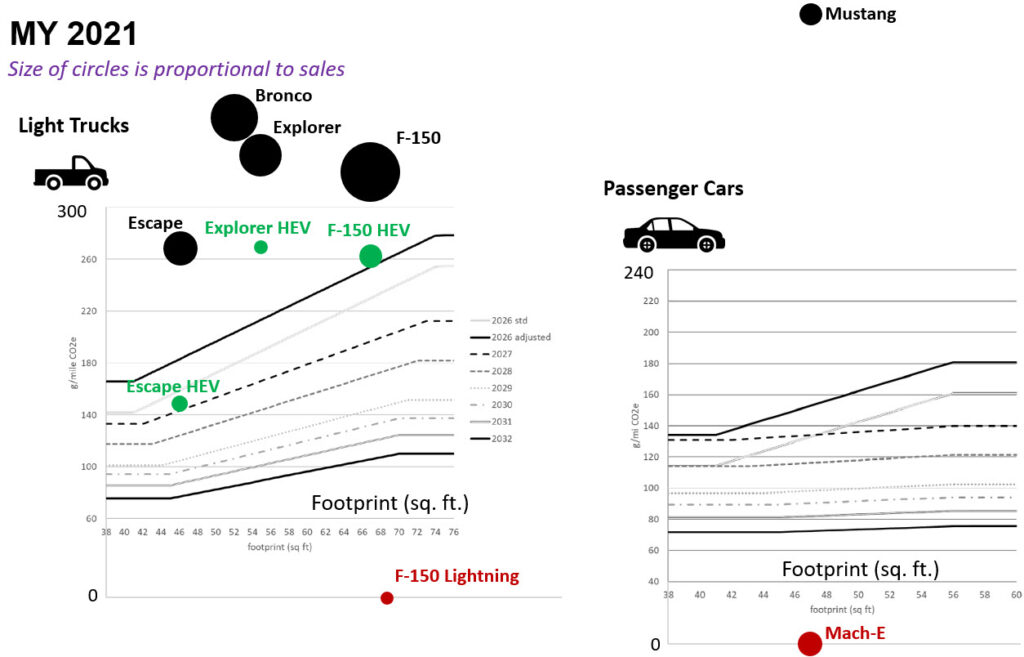

MY 2021 Fleet

Here are the EPA CO2 test values for the various models selected in this fleet. We show here both the light-truck and sedan footprint based curves, but drop the sedan in the subseques figures for clarity (the only sedan here is the Mustang, which we assume is discontinued and replaced by the all-electric Mach-E in 2030).

The size of the circles is proportional to the sales of each model (taken for MY 2021)

The sales-weighted fleet averaged CO2 came to 302 g/mi – which coincidentally is very close to the EPA reported value of 300 g/mi for Ford in the Automotive Trends Report. We say coincidentally because this study does not include all but only select high-selling models.

MY 2030

Three scenarios were considered for meeting the MY 2030 target

(~ 120 g/mi for this fleet, ~ 60% reduction compared to 2021 !):

Scenario 1 : Only hybrids and EVs sold

For all models which have a hybrid (e.g. Explorer) or electric (e.g. F150) variant, 100% sales are shifted to the electrified version. Still, the fleet could not meet the 2030 target and we have to introduce a new EV, in this case a hypothetical battery electric variant of the Bronco was used – and sales adjusted to meet the 2030 target.

Scenario 2 : Same as above but a new hybrid variant was introduced for the Bronco. This still also required a full electric variant (with lower share) to meet the target.

Scenario 3 : Same as above but a plug-in variant was introduced for the Bronco and Explorer. This allowed for a < 100% share of the F150s to be fully electric – perhaps a more reasonable scenario for 2030.

Each scenario met the 2030 target (within 1 g/mi). Sales of the electrified variants were adjusted to meet the CO2 target, while keeping the total sales for each model the same as for MY 2021.

The figure below shows a summary of these scenarios. Note that the circles and text in grey represents models that have been considered as discontinued compared to the MY 2021 fleet (these are the ICE-only variants).

Key Takeaways

A few observations based on the study above:

- Clearly the 2030 targets are extremely challenging – even a 100% shift to the fully electric F150 truck is not sufficient to meet those (!) without resorting to other measures.

- Both fully electric and hybrid versions are going to be important and sold in big numbers

- Meeting the targets will require introduction of new hybrid / plug-in / full electric models

- The BEV share for this case ranges from 36% to 55% – a rather large spread – depending on the strategy pursued.

- We have also calculated the batteries required for the fleet (using known battery capacities and assuming those for new models) – and the table shows that up to 20% reduced batteries are required for the 3rd scenario with plug-in hybrids. This may be an important consideration in a battery resource constrained future.

What's Missing

A lot .. but here are some key points:

- Again, this is an overly simplified study taking only a few models – the reality of an OEM fleet is much more complicated with several models and their various trims.

- We have not considered any ICE fuel efficiency improvements here. It is quite possible that fuel consumption drops by another 10% by 2030, especially for some high consuming models such as the Bronco. That will further reduce the EV share required.

- We have not considered any off-cycle credits

- A big one – we have not considered any trading of CO2 credits. An OEM can pursue buying credits from other EV manufacturers such as Tesla and this will further reduce the EV share required to meet the CO2 target.

- Finally, this is an analysis for a truck-heavy fleet. Of course this would look very different for say, a Toyota, which has more sedans and more hybrids. We need to do this for other such example fleets.

The key message here is that there are multiple approaches for meeting the future CO2 standards, and the task is very complex for an OEM as they have to, in addition, make sure that they satisfy those additional pesky requirements of consumer demand and profits.

Sign up here to receive such summaries and a monthly newsletter highlighting the latest developments in transport decarbonization

5-Min Monthly

Sign-up to receive newsletter via email

Thank you!

You have successfully joined our subscriber list.