Regulations

CARB Proposed Modifications to the Low Carbon Fuel Standard

Background

On August 12th, 2024, the California Air Resources Board (CARB) posted the latest proposed amendments to the Low Carbon Fuel Standard (LCFS). These confirm some of the previous amendments proposed earlier this year, while introducing new ones. Here is a recap of some of the important proposed changes.

EPA Demands Manufacturer Data as It Expands Action on DEF System Failures

February 15, 2026

No Comments

![]()

A brief summary of recent EPA changes to DEF-related failures.

EPA repeals 2009 GHG endangerment finding

February 12, 2026

No Comments

![]()

The US EPA is repealing the 2009 GHG endangerment finding and terminating all vehicular GHG standards.

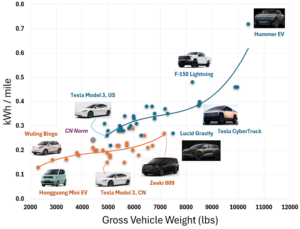

Efficiency of EVs in US and China

January 25, 2026

No Comments

![]()

China has set energy efficiency norms for electric vehicles – how do modern EVs fare?