The 13th edition of the BP Energy Outlook includes two scenarios, one the current trajectory and another, an ambitious one for reaching net zero by 2050.

Summary: Four key elements to accelerate the energy transition

- Whole world needs to decarbonize, not just the developed regions

- Energy efficiency needs significant acceleration to move from energy addition to energy substitution

- Decarbonize power systems

- Application not invention – move to net zero will require rapid adoption of current available technologies, not innovation of new ones.

Problem – Managing energy growth and substitution:

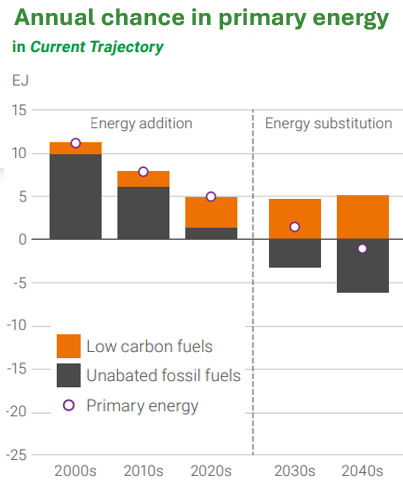

We are still in an energy growth period and consumption of both fossil fuels and low carbon fuels is growing. Fossil fuels still account for over 80% of primary energy today, and with the current trajectory, fossil fuel will still account for nearly 2/3rd of primary energy by 2050.

- Meeting net-zero goals will require improved energy efficiency and acceleration of the substitution of fossil fuels with low carbon fuels.

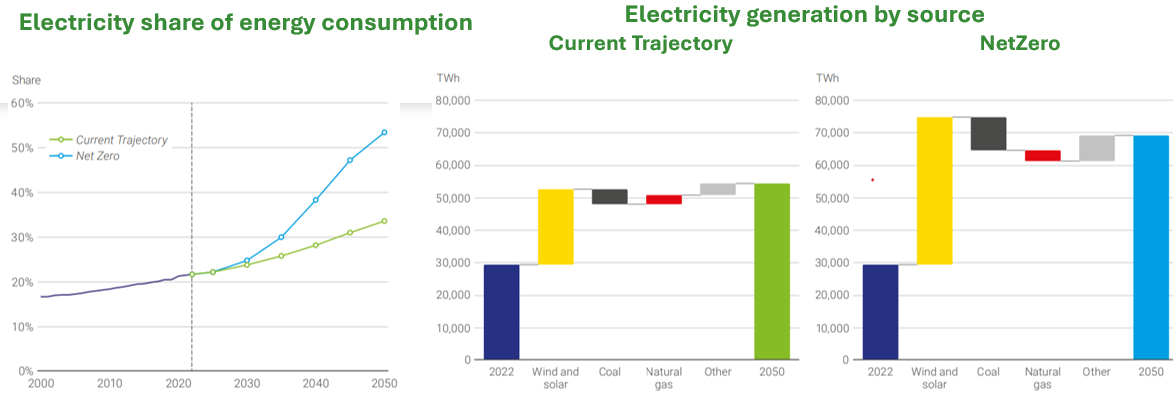

- The net-zero scenario envisions the use of electricity to meet over 50% of the total energy demand by 2050 (vs. ~ 20% today). Most of this growth happens in emerging economies with improving living standards.

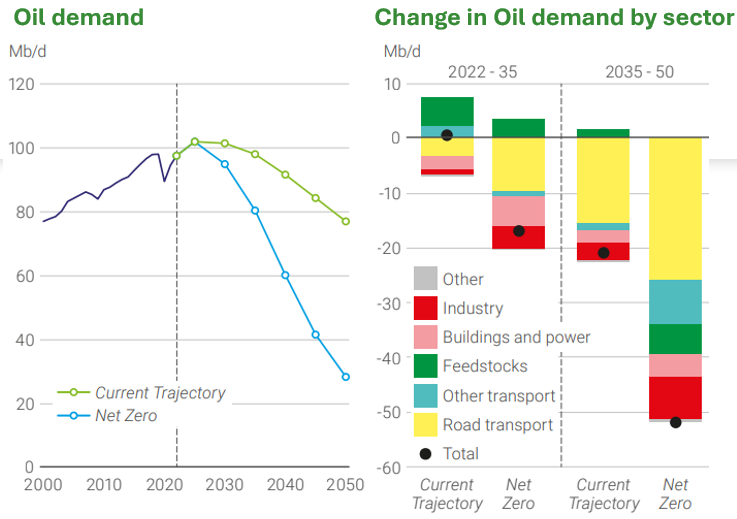

Oil Demand is expected to remain stable in the current trajectory for the next few years before beginning a slow reduction post 2030. By 2050 the oil demand will be only ~ 25% lower than today. The net-zero scenario sees a ~ 70% reduction in the same time period. The reduction in demand is primarily driven by the electrification of the transport sector.

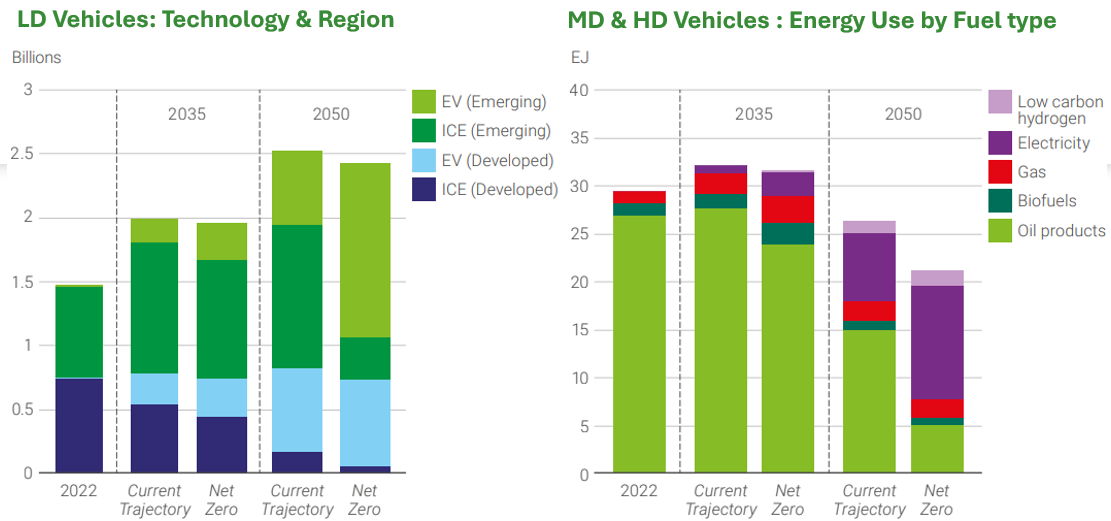

Speaking of transport, it is projected that the total vehicle parc increases from 1.5 billion vehicles today to ~ 2 billion in 2035 and 2.5 billion by 2050.

Electric vehicles grow rapidly in share for light-duty vehicles, but even in 2050 more than half of the fleet is expected to have an internal combustion engine in the current trajectory.

For medium and heavy-duty vehicles, the energy consumption is seen to decline beyond 2035. Still, by 2050 electricity and low carbon H2 accounts for only 1/3rd of the energy used.

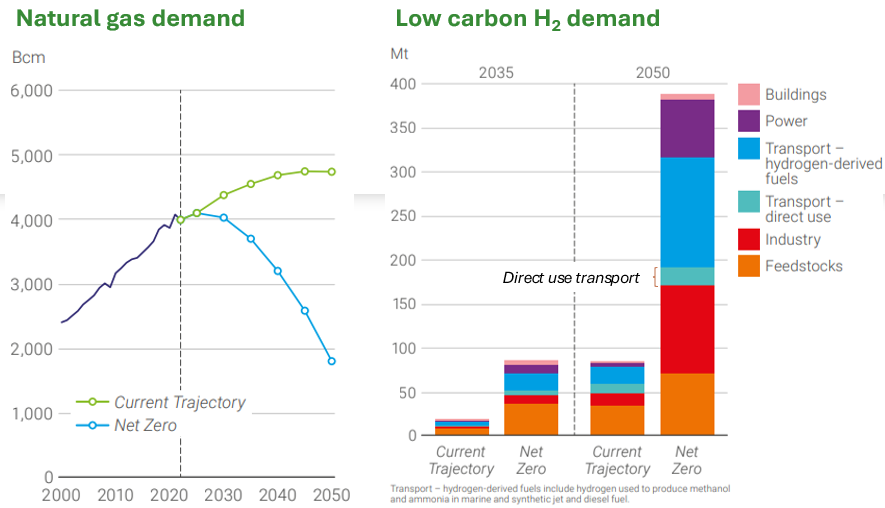

The projections for natural gas and low carbon hydrogen demand vary widely based on the extent of decarbonization and electrification. For natural gas, the current scenario could result in continued increase up to 2050 due to emerging economies switching to the fuel from coal, while in the net zero scenario it reduces due to renewables.

The demand for green hydrogen in the net-zero scenario increases five-fold compared to the use of gray hydrogen today, signaling the challenges that should be expected for such a massive scale-up. Note also that the use for direct transport is expected to be rather limited but the majority use is projected for hydrogen-derived fuels.

The cost of alternative fuels will decrease with scale, but are expected to continue to be expensive compared to fossil fuels, and their adoption will require the willingness of society to bear the additional cost.

It should hardly come as a surprise that in both scenarios, the outlook projects a significant shift and therefore a growth in electricity demand. The key difference in the current vs. net zero scenarios is the extent of grid decarbonization.

Total power generation is expected to nearly double from ~ 30,000 TWh today to > 55,000 TWh in current trajectory and ~ 70,000 TWh in net-zero scenario. The contribution from wind and solar is expected to increase from ~ 15% today to 50 – 70% by 2050 – but will require many factors to come together for that to happen (cost, infrastructure, resilience, social acceptance, etc.)

The biggest difference in the scenarios is the pace of decarbonization of the power sector. This is especially difficult in the emerging economies which must balance the need of growth in electricity consumption and transition to renewables. Adoption of low carbon technologies by the industrial sector is the next important factor. Transport comes in third, highlighting the need for electrification in developing markets.

Sign up here to receive such summaries and a monthly newsletter highlighting the latest developments in transport decarbonization

5-Min Monthly

Sign-up to receive newsletter via email

Thank you!

You have successfully joined our subscriber list.

Recent Posts

Conference Summary – SAE WCX 2025

![]()

A summary of the “SAE WCX 2025” conference held in Detroit.

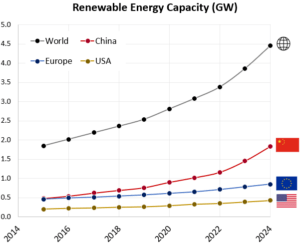

IRENA Renewable Energy Capacity Statistics 2025

![]()

According to the latest report from IRENA, 2024 saw the largest increase in renewable capacity, accounting for 92.5% of overall power additions.

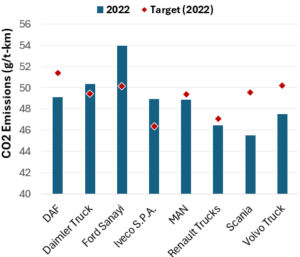

CO2 Emissions Performance of Heavy-Duty Vehicles in Europe – 2022 Results

![]()

The European Commission has published the official 2022 CO2 emission results for heavy-duty vehicles. Many OEMs are ahead of the targets and have gained credits, while others have their work cut out as we approach the 2025 target.