Conference Summary

Biofuels summit highlights role of ethanol in transport decarbonization

Growth Energy Biofuels Summit, Sept. 9 – 12, 2024, Washington DC

Biofuels Summit, Washington, DC

The Growth Energy Biofuels Summit was held in the nation’s capital on September 9–12, 2024. The event was held near Capitol Hill and featured guest speakers from several senior government officials (Sec. Tom Vilsack, USDA, Administrator Michael Regan, EPA) and a host of panel discussions on various topics pertaining to the role and future of ethanol in the decarbonization of transport.

(Image - Flags marked the 9/11 commemoration.)

Context

The US produces and consumes nearly 15 billion gallons of ethanol each year. The production is limited not by the capacity but the implicit caps on the amount that can be blended in. The case for increasing ethanol use rests in the work being done by the farmers and industry to continue lowering the lifecycle carbon intensity of the fuel, that renewable fuels are the only pathway to reducing emissions from the existing fleet, and that there are new hard-to-decarbonize end-uses such as heavy-duty engines and aviation.

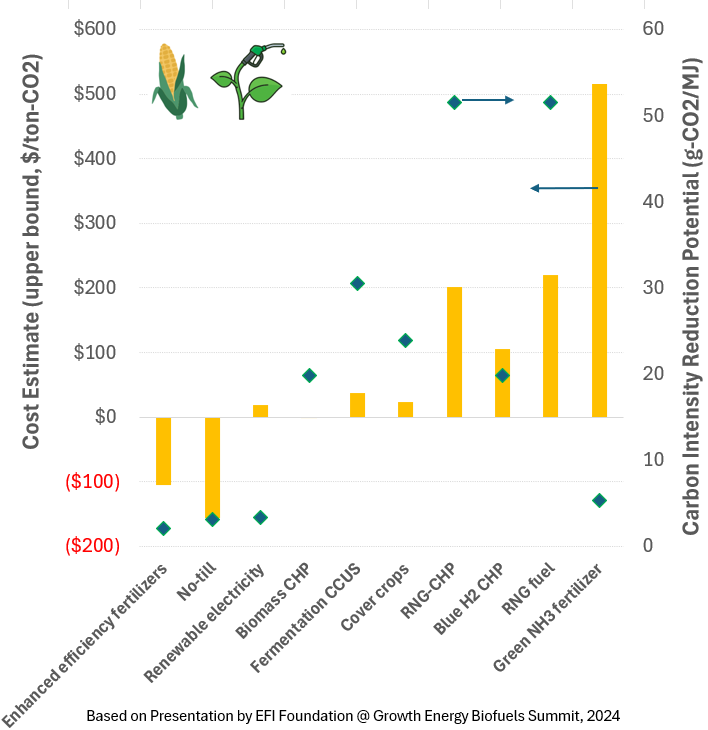

The plot here shows some of the technologies that have the potential to reduce the carbon intensity of ethanol and the upper bound on the costs. This is based on work done by the EFI Foundation which is going to release a detailed report later. There have been other studies which quantify the carbon intensity of ethanol and pathways for further reduction which we have covered previously.

EPA Demands Manufacturer Data as It Expands Action on DEF System Failures

![]()

A brief summary of recent EPA changes to DEF-related failures.

EPA repeals 2009 GHG endangerment finding

![]()

The US EPA is repealing the 2009 GHG endangerment finding and terminating all vehicular GHG standards.

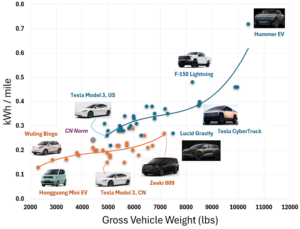

Efficiency of EVs in US and China

![]()

China has set energy efficiency norms for electric vehicles – how do modern EVs fare?