Biodiesel and Renewable diesel production in the US hits a speedbump

In the U.S., qualified biodiesel producers or blenders were eligible for an income tax credit of $1.00 per gallon of biodiesel (B100) or renewable diesel produced or used in the blending process. This “blenders tax credit” ended on December 31st, 2024, and has thrown a wrench in the production of these biofuels.

The U.S. Department of Treasury has released a guidance on a new Clean Fuels Production Credit, also known as 45Z, but which is not a final rule or even a proposal at this point.

MOBILITYNOTES MEMBERS: We have summarized the 45Z guidance previously, MobilityNotes members can download a summary here.

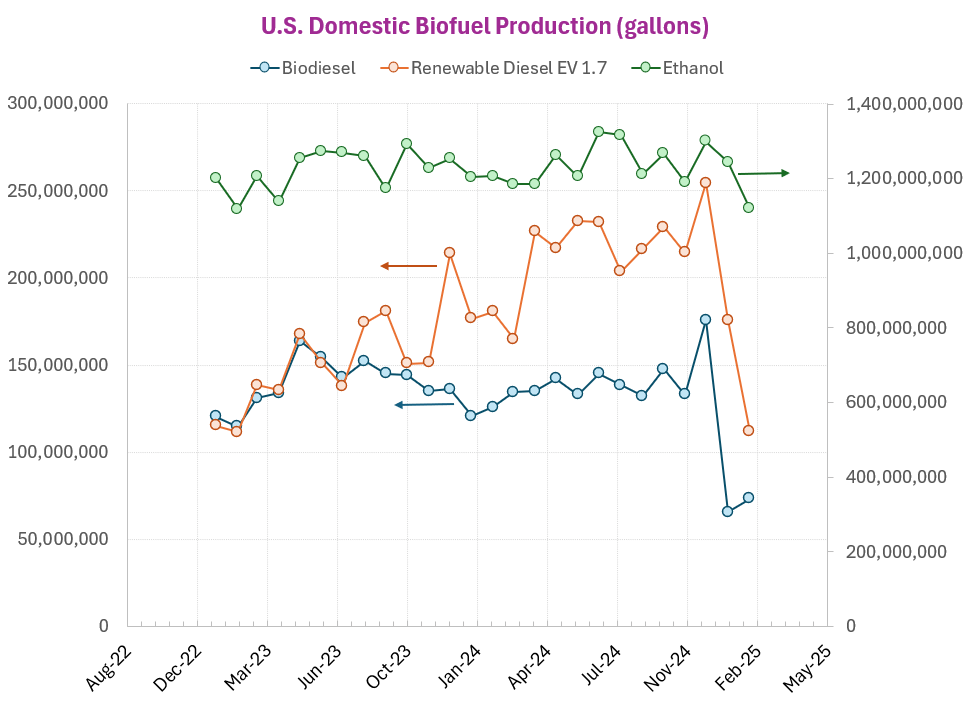

Given the uncertainty on the 45Z credit, much of the biodiesel and renewable diesel production has stopped or slowed considerably. Here’s a chart showing the drastic reduction in fuel output seen in the first two months of this year.

(For reference, we also show the output of ethanol which also seems to have reduced but to a much smaller extent)

Source of data: EPA.gov

Implications

The reduced production of biodiesel negatively impacts the employment of those in the production process, and ultimately farmers who produce feedstock such as soybeans. For now, producers have mostly refrained from laying off workers (see Iowa as an example), but clarity is needed quickly.

Biofuels present the fastest way to decarbonize the existing fleet of heavy-duty vehicles, and a reduction in the renewable fuels is not good for the environment either.

Sign up here to receive such summaries and a monthly newsletter highlighting the latest developments in transport decarbonization

5-Min Monthly

Sign-up to receive newsletter via email

Thank you!

You have successfully joined our subscriber list.

Recent Posts

EPA Demands Manufacturer Data as It Expands Action on DEF System Failures

![]()

A brief summary of recent EPA changes to DEF-related failures.

EPA repeals 2009 GHG endangerment finding

![]()

The US EPA is repealing the 2009 GHG endangerment finding and terminating all vehicular GHG standards.

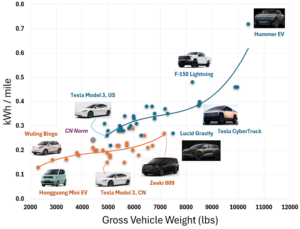

Efficiency of EVs in US and China

![]()

China has set energy efficiency norms for electric vehicles – how do modern EVs fare?