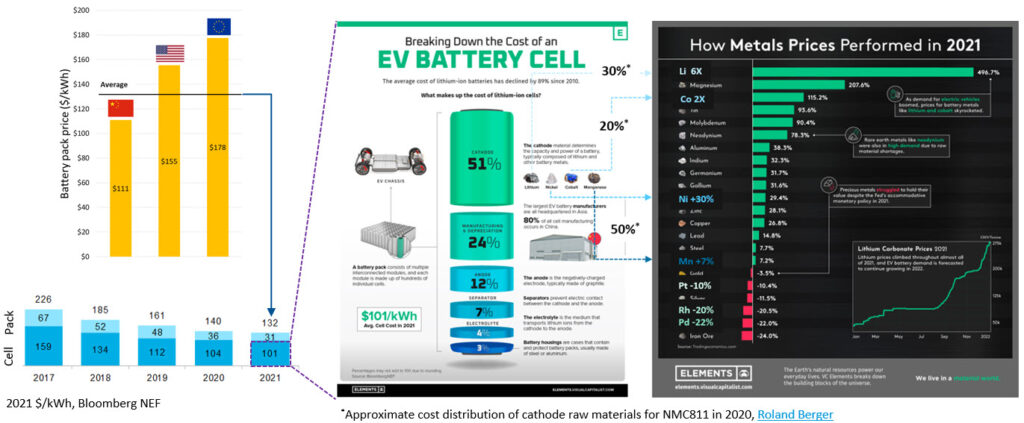

Do raw material constraints pose a speed bump to the $100/kWh target?

Visual Capitalist has put out a nice graphic on the cost breakdown of a battery cell in 2021. Added here are a couple of other graphics to lend a bit more color to the story.

From left to right –

- Battery prices are lowest in China (no surprise) and are 40 – 60% higher in the US/EU.

- Cell prices have dropped by ~ 36% in the last 5 years. There is a ~ 30% markup from cell to pack prices today. This is for light-duty only – heavy-duty packs are much more expensive

- Almost half of the cost of the cell is cathode materials. Of these raw materials, 30% cost approximately is attributed to Li, 20% to Cobalt and the rest to Nickel and Manganese.

- Prices of these critical raw materials (Li, Co, Ni, Mn) have increased substantially in the last quarter or so, such that the cell price has actually increased by ~ $10/kWh in Q4, 2021 – not shown here.

- It will be interesting to see how the supply / demand of these raw materials affects the timing for < $100/kWh pricing.

Also not included above is the price of LFP, which is ~ 30% lower than NMC.

If you like such content, check out the monthly newsletter covering the latest on sustainable transportation technologies and regulations. Sign up below.

Like it ? Share it !

Other recent posts

Conference Summary – SAE WCX 2025

![]()

A summary of the “SAE WCX 2025” conference held in Detroit.

IRENA Renewable Energy Capacity Statistics 2025

![]()

According to the latest report from IRENA, 2024 saw the largest increase in renewable capacity, accounting for 92.5% of overall power additions.

CO2 Emissions Performance of Heavy-Duty Vehicles in Europe – 2022 Results

![]()

The European Commission has published the official 2022 CO2 emission results for heavy-duty vehicles. Many OEMs are ahead of the targets and have gained credits, while others have their work cut out as we approach the 2025 target.