California Advanced Clean Cars II Light-Duty electrification requirements and estimate on battery implications

Here’s a one line summary – the US will require about 10X the current Li-ion battery manufacturing capacity by the end of this decade.

Read on for why.

California’s Air Resources Board has published the “Initial Statement of Reasons” along with the latest detailed proposal for the ACC 2.0 rule and set a date of June 9th for the Board hearing. Public comments are due through the end of May.

Here are some highlights of proposed requirements for electrification:

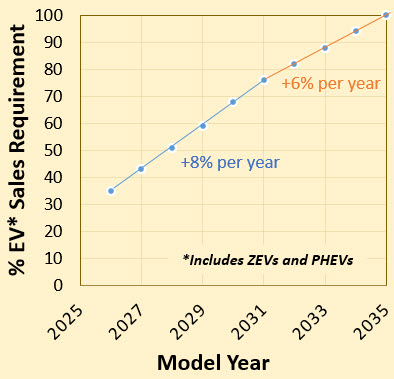

- 100% new sales of light-duty to be ZEVs* and PHEVs* by 2035, increasing at 8% per year from 2026 – 2031 and 6% thereafter.

- Change from “credit” to “value” system, with each EV compliant with technical requirements counting as one.

- Technical requirements for ZEVs beyond 2026 include range >150 miles, ≥76 kW on-board charger, capability for DC fast-charging, and compliance with battery durability and servicing requirements.

- PHEV’s can only count up to 20% of ZEV requirements. Technical requirements are > 50-mile range + > 40-mile on US06, and compliance with SULEV emission standards.

- Post MY 2026 EVs will need to monitor battery deterioration through a “state of health” monitor for batteries, which correlates with usable energy. This will be displayed on the dashboard.

- Durability requirements include maintaining 80% of range for 10 years / 150,000 miles (as reference Tesla Model S & X vehicles have shown < 10% for vehicles driven to 200,000 miles).

- Environmental Justice provisions have been introduced. One allows manufacturers to earn an additional vehicle value of 0.5 if a ZEV is sold to disadvantaged communities at > 25% discount off MSRP. Another gives an additional 0.1 vehicle value for low cost EVs, priced ≤ $20,275 for cars and ≤ $26,670 for LD trucks.

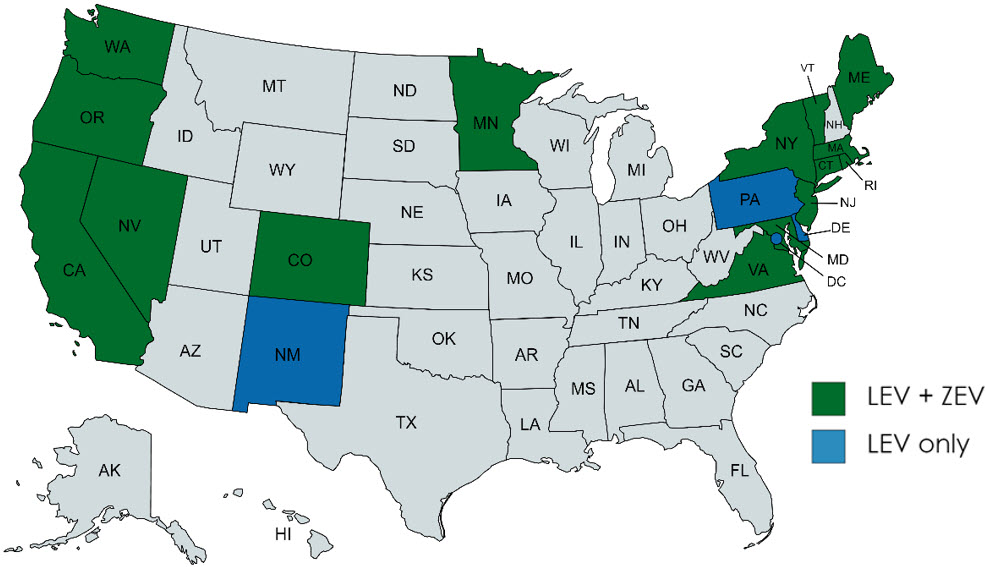

Other states follow California’s tailpipe emission and electrification standards. There are 14 such “section 177” states which have adopted the ZEV regulation (Pennsylvania and New Mexico follow the emission standards but not the electrification ones, yet).

Today, these states plus California represent roughly a third of the US market for light-duty vehicles.

Note that the ACC II proposal allows for pooling of up to 25% of ZEV requirements across these “section 177” states, but this reduces to 5% by 2030.

Implication for the market for electric vehicles

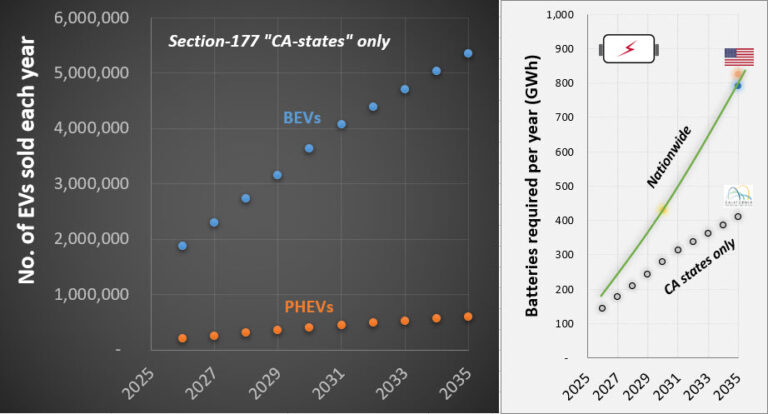

Here’s a simple estimation of the number of ZEVs sold and the amount of batteries required each year, per this proposal.

Note that the actual numbers will be somewhat different due to deviation from these assumptions but also because of the use of available and other (e.g. EJ) credits and of course actual customer pull for EVs, charging infrastructure availability, other unforeseen events etc. Still, this analysis is sufficient to get a ballpark estimate.

Some assumptions on vehicle sales and battery pack sizes –

——————————————————————-

No. of vehicles sold each year in the US : 17 million

Fraction of vehicles sold in “CA-states” : 35%

Market share of PHEVs = 10%

Avg. battery size of BEV = 75 kWh (e.g. Tesla Model Y, Kia EV6)

Avg. battery size of PHEV = 15 kWh (e.g. Ford Escape PHEV has a 14.4 kWh battery)

——————————————————————-

The above coupled with the ACC II EV requirements result in the EV sales per year as shown in the left plot. The plot on the right translates that to battery capacity required. Shown are two curves – one for CA states and another for the entire US assuming that the rest of the country reaches 20% EV share by 2030 and 50% or 75% share by 2035.

It is seen that the battery requirement each year is ~ 430 GWh by 2030 and ~ 800 GWh by 2035 for the US alone. And to put this in perspective, the total Li-ion battery manufacturing capacity in the US is ~ 44GWh in 2021. So we need a roughly 10X increase in capacity by the end of the decade and another 2X in the next 5 years.

Note that these numbers could be quite conservative, given the trend towards larger and heavier vehicles requiring larger battery packs in turn, greater than the 75 kWh assumed here.L

If you like such content, check out the monthly newsletter covering the latest on sustainable transportation technologies and regulations. Sign up below.

Like it ? Share it !

Other recent posts

Conference Summary – SAE WCX 2025

![]()

A summary of the “SAE WCX 2025” conference held in Detroit.

IRENA Renewable Energy Capacity Statistics 2025

![]()

According to the latest report from IRENA, 2024 saw the largest increase in renewable capacity, accounting for 92.5% of overall power additions.

CO2 Emissions Performance of Heavy-Duty Vehicles in Europe – 2022 Results

![]()

The European Commission has published the official 2022 CO2 emission results for heavy-duty vehicles. Many OEMs are ahead of the targets and have gained credits, while others have their work cut out as we approach the 2025 target.