Electric and hybrid penetration by 2030 based on new CO2 targets

What’s changing with fuel economy standards?

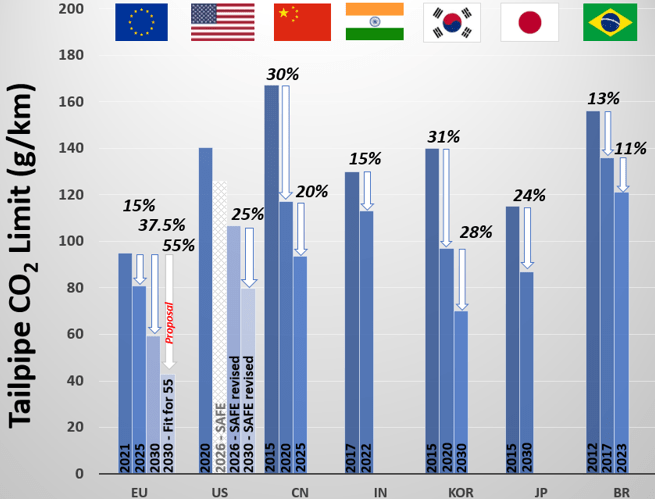

The European Union has proposed changes to the CO2 tailpipe limits for light-duty vehicles as part of the “Fit for 55” package.

For 2030, here are the revised targets:

Passenger cars: Current 37.5% reduction to be replaced with a 55% reduction, versus 2021 levels

Vans: 31% replaced by 50% reduction versus 2021 levels.

Also proposed is a ban on the sale of any new light-duty gasoline or diesel vehicle beyond 2035.

In the US, the Biden administration is revising the light-duty vehicle economy “SAFE” standards. Current EPA standards require a 1.5% reduction each year, while California had struck a voluntary deal with a few OEMs for a 3.7% reduction. Here is a possible scenario:

US EPA aligns with California for a 3.7% reduction from model year 2023 – 2026

For model years 2027 to 2030, the standards will get even tighter, perhaps a 6 – 7% reduction each year.

Biden has also signed an executive order setting a target of 50% electrification (including plug-in hybrids and fuel cell vehicles) by 2030.

Note the words “proposals, scenario, possible” etc. peppered throughout – much of the above is uncertain but one thing is sure, we are looking at significant tightening of fuel economy standards in the two major automotive markets.

Other recent posts

EPA Demands Manufacturer Data as It Expands Action on DEF System Failures

![]()

A brief summary of recent EPA changes to DEF-related failures.

EPA repeals 2009 GHG endangerment finding

![]()

The US EPA is repealing the 2009 GHG endangerment finding and terminating all vehicular GHG standards.

Efficiency of EVs in US and China

![]()

China has set energy efficiency norms for electric vehicles – how do modern EVs fare?

Like it ? Share it !